Total Recon

Complete Credit Card Reconciliation in Minutes.

Save Time with Flawless Transaction Matching

Credit card payments are increasing and so, too, are the exceptions. Transactions can post all too easily as different dates in different systems due to the variations between the POS and payment processors, disconnected mobile unit, or overnight purchases, as examples.

Evention Total Recon matches 99% of credit card transactions in minutes with our proprietary algorithm. This means you and your teams can focus on addressing the exceptions and reallocate your saved time to more impactful initiatives.

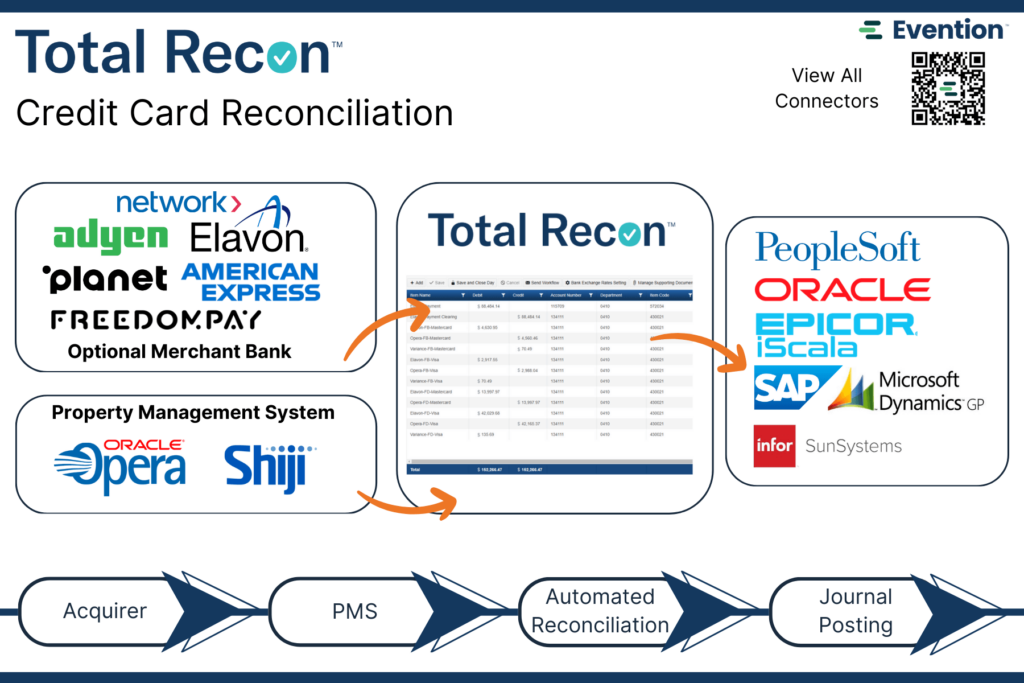

How it Works: Take the Next Step in Your Credit Card Automation Process

Reconciling manually between payment systems can take hours across every location and feel like you’re searching for “a needle in a haystack” when you factor in different posting dates. By automating reconciliation with Total Recon, you can get the visibility you need at the transaction level and the accuracy you want at the enterprise.

- Reconcile with visibility to the individual transaction by either the cashier or the register.

- Reconcile the payment processor against your Point-of-Sale or Property Management System.

- Post to your accounting platform of choice.

Reconcile both Cash and Credit with Evention Total Recon

Total Recon is the only solution that offers complete payment reconciliation, including both cash and credit card, in one connected system. With Total Recon, you’ll have a reconciliation process that’s fast and repeatable for anyone on your finance team.

Unlock Transaction Level Visibility with Total Recon

Reconcile all payments across your unique ecosystem and easily identify discrepancies down to the individual transaction.

- Access web-based reports with flexible date ranges for deeper insights, driving cost optimization.

- Implement dual controls and maintain an audit log for protection, ensuring standardized processes across all locations.

- Hold team members accountable for discrepancies with detailed violation views and configurable violation notifications.

Your Complete Guide to a Better Cash & Credit Card Reconciliation Process

Looking to learn more about how automated reconciliation can save you time and safeguard your revenue?

Connected to Your Payment Processors, Gateways, POS, and Accounting Software

Evention connects to 60+ of the devices and applications you use every day. We connect your entire ecosystem of providers for point of sale (POS), payment processors, and payment gateways for reconciliation.

We’re happy to work with your unique set of existing devices and providers and have experience with complex ecosystems. If you don’t see your provider, just ask. We’re always adding more.

20+ Years of Reconciliation Service Expertise

With 20+ years of serving enterprise customers, we excel in connecting complex payment ecosystems to deliver true reconciliation from transaction to bank. Our implementation guides partner with you to create your Total Recon solution along with developing the change management process. Post-implementation, we are proud to offer global customer support 24/7.

Total Recon FAQ

Schedule a Consultation

Schedule time to discuss your current reconciliation process and options for optimizations with industry veterans.